Are you looking for more tips, tricks, and how-to articles on reporting in NetSuite? Check out our NetSuite Reporting Resource page.

Financial Reporting, Systems, ERP, Technology, NetSuite

January 10, 2024

2 min Read

Five NetSuite Reports For A More Efficient Financial Close

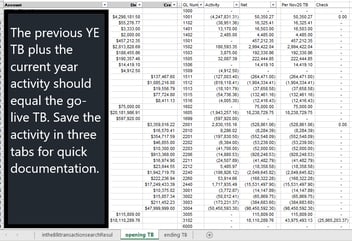

Adding automation to your financial close increases efficiency and reduces the chance for error in your reporting process. When working on a tight SEC deadline for 10-Q and 10-K reporting, every hour saved helps. If using NetSuite as an ERP, below are five custom reports that can improve efficiency in the close process. This article assumes that companies are using the general ledger account, functional department, and class segments in NetSuite.

-

GAAP income statement: The functional department likely determines the income statement expense classification as either a general and administrative (G&A) or research and development (R&D) department. Build a GAAP income statement by combining the total expenses (account type 'Expenses') for the department grouping. Add appropriate columns, such as prior fiscal quarter and the prior year, for the period comparison.

-

GAAP balance sheet: Build the balance sheet around the GL account grouping in each unique financial statement line item (FSLI). NetSuite does not allow users to customize the generic FSLI options in the standard balance sheet. Hence, you need to build a custom report to match your organization's groupings.

-

Supplemental disclosure of cash flow information: Two cash flow disclosures you can automate are cash paid for income taxes and purchases of property and equipment included in accounts payable and accrued expenses. Using a NetSuite saved search, you can query transactions coded to an income tax expense account or transactions coded to a PP&E account that is in a journal entry.

-

Management discussion and analysis (MD&A) explanations for G&A expenses: Companies provide high-level descriptions for changes in their G&A spending within the MD&A. Using a custom financial report, you can group accounts into the appropriate category and only transactions coded to G&A departments. Typical types include salaries and benefits, facility-related costs, and consulting / legal fees.

-

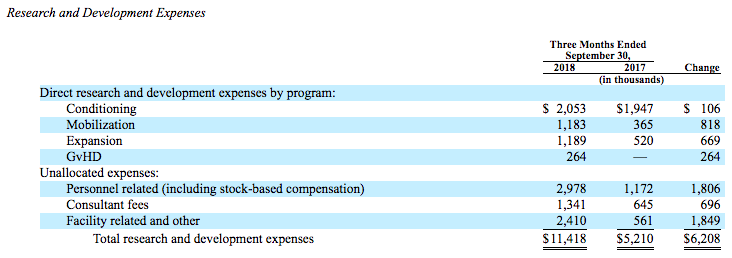

MD&A direct R&D expenses table: Biotech companies also disclose a direct R&D spend table in their MD&A, which reconciles to the income statement. Using a custom financial report, you can calculate total program expenses and group accounts for the general costs. And like the G&A expenses above, you would filter transactions to only include transactions coded to R&D departments. See below for an example disclosure from Magenta's Q3 2018 10-Q:

Automating reports used in the financial reporting process adds efficiency to the close and reduces the chance for user errors. If your company needs assistance in building NetSuite reports, contact intheBlk consulting. We have experience supporting small, publicly-traded organizations with their financial close.