Financial Reporting, Long Range Planning, Budgeting

July 26, 2023

2 min Read

What is a Long Range Plan, Budget and Forecast?

Are you a growing biotech organization looking to upgrade your accounting software? Check out our NetSuite Implementation Resource page for guides and help articles on starting the review for proposal (RFP) process.

You might think that a long-range plan (LRP), budget, and forecast are interchangeable. However, each of these tools plays a unique role in the financial planning and analysis (FP&A) process. The differences were hazy to me until I worked in an FP&A role. Below, I discuss how these tools ensure financial and strategic success.

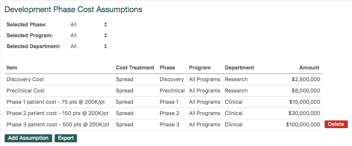

An LRP is a long-term strategic financial plan, generally covering at least three years. The LRP planning process aligns the financial direction of the organization with its strategic goals. Predicting clinical and development costs five years in the future is challenging for biotech organizations. Thus, an LRP uses high-level, standard cost assumptions based on historical data, experience, and objective sources. An LRP also maps critical inflection points and the associated hires, financings, and business development deals. The LRP can assess best-case, worst-case, and base-case scenarios and the associated financial impact.

A budget is a financial plan covering the next twelve to eighteen months and is more detailed than an LRP. Senior leadership should ensure that the business goals drive the budget. A budget is approved by the board of directors once a year, usually in December. Once approved, the organization can hold people accountable for spending that did or did not occur throughout the year, often called a budget-to-actual analysis. The original budget is static and doesn't change after approval.

A budget includes details at the segment level. Standard reporting segments include general ledger (GL) accounts, departments, classes, locations, and operating subsidiaries. Check out my article on segment structure basics for more information on setting up segments. The reporting segments used in the budget should match how the accounting team tracks transactions in the enterprise resource planning (ERP) software. When the budget and actual segments are aligned, preparing and analyzing budget-vs-actuals is much easier.

Budgets go stale quickly when unforeseen events occur. For example, when the COVID-19 pandemic hit in March 2020, many organizational budgets became irrelevant. Circumstances like this are where the forecast comes in. A forecast is the revised budget based on new information. The type of change will drive the level and scope of the forecast process. Again, this is another tool to hold people accountable for spending that did or did not occur. For some years, a forecast may not be necessary. Other years might require several forecasts.

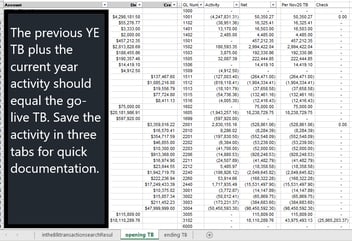

I highly recommend loading the budget and forecast into your accounting software to ease the burden of preparing and analyzing budget-vs-actual reports. Accounting systems, like QuickBooks Online and NetSuite, will allow organizations to manage multiple budgets and forecasts. Users can quickly run reports and analyze differences between actuals and budgets with a loaded budget file in the ERP system.

At intheBlk consulting, we aim to make the accounting team more efficient by utilizing technology. Contact us to get specific help or check out our reporting resource center for more helpful tips and tricks.