Reporting, QuickBooks, Intercompany

January 10, 2024

2 min Read

Best practices for organizing intercompany balances in QuickBooks

As companies expand their operations, they often form new legal entities for legal and tax reasons. As a result, the accounting team must prepare and analyze consolidating financial statements, including eliminating intercompany balances. Unfortunately, QuickBooks does not support this systematically, so accountants must complete this process outside the system. This blog post discusses best practices for organizing these intercompany balances to ease this manual process.

I'm going to start with an example company structure. See the screenshot below. I will be referencing this throughout the post.

![]()

Here are a few best practices for organizing intercompany balances in QuickBooks:

-

Each legal entity should have its own QuickBooks file - While slightly more expensive and some additional work, this ensures that separate books and records are kept, which is a requirement of all US states. Practically, this will help prevent mistakes like paying Child Company B's vendor bill with a vendor payment from Parent Company's A bank account. Users can also run standalone financial statements for tax and audit purposes when needed.

-

Have a shared chart of accounts across all entities - This will make preparing consolidated financial statements easier to prepare and analyze. You can export transaction detail reports and use SUMIFS and VLOOKUPS with the same account number. The downside here is that it's more work to keep up. A single chart of accounts will be required when the company implements a more extensive ERP system, like NetSuite.

-

Include the offsetting legal entity in the GL account name - Users will want to track intercompany balances between legal entities to ensure these balances eliminate in consolidation. If each entity has its own QuickBooks file, a user can identify the originating entity based on the QuickBooks file. Users can quickly identify the offsetting entity if this information is included in the account name. See the example GL account names above. This setup means you only need one account per subsidiary rather than accounts for each relationship.

-

Keep intercompany P&L accounts separate from 3rd party P&L accounts - This will help identify how these balances eliminate in consolidation. Again, users should include the offsetting entity within the account name.

-

Consider using a tool like Qvinci for managing consolidated financial statements - Save the time of preparing consolidated financial statements in Excel. Instead, use a tool like Qvinci to organize, track and analyze the consolidated financial statements. The QuickBooks app store includes other options for consolidating financials across multiple QuickBook files.

Is your organization struggling to prepare and analyze financial statements across multiple entities in QuickBooks? If so, it might be time to implement a more extensive ERP system like NetSuite. Are you concerned about losing that historical data? Talk to intheBlk consulting about how we can:

-

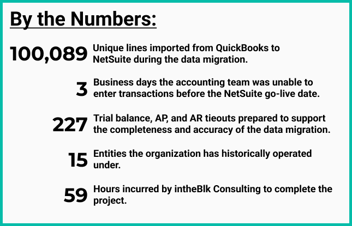

Preserve your financial history by migrating the QuickBooks data to NetSuite. We recently assisted an organization in migrating 15 QuickBooks Online files to a single NetSuite file.

-

Prepare the required journal entries necessary to prepare consolidated financial statements within NetSuite.

-

Guide you and your team on the data conversion process during your NetSuite implementation.