Initial Public Offering, NetSuite, Implementation

March 8, 2023

3 min Read

Should I implement NetSuite before or after an IPO?

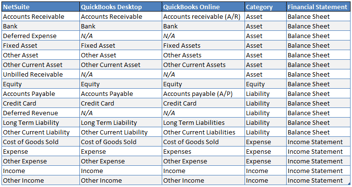

Almost all startups use QuickBooks as their initial accounting software, with good reason. QuickBooks is an easy-to-use, affordable tool for small accounting teams.

If your organization plans to complete an initial public offering (IPO), you should consider upgrading your accounting software to NetSuite. NetSuite customers have made up 66% of tech IPOs since 2011 in the US. However, this begs the question - should I implement NetSuite before or after an IPO? Below are a few questions to consider:

-

How much historical data do I have? The less historical data you have, the easier your implementation will be. Waiting 18 months to implement means you will have 18 months of additional data to import. Manually importing historical data into a new system can be a heavy load on a team adjusting to life as a public company. Consider working with OptimalData to import your historical transactions into NetSuite. Once you are a public company, the auditors will make quarterly rather than annual audit requests. With OptimalData's approach, you can have all your financial transactions in a single system, no matter what time of year you implement NetSuite.

Related Article: read how OptimalData imported all of Akouos' historical financial data from QuickBooks to NetSuite.

-

How much bandwidth does your team have? There is never a good time to implement a system, but certain times of the year are better than others. During the planning phase, discuss timelines with your implementation team. Often, you can work around critical deadlines if there is advanced notice. Remember, as a public company, your team's financial close is much tighter than when private. Don't jeopardize your ability to close the books because of a poorly executed system implementation. Consider adding a consultant, such as OptimalData consulting, to assist with the data conversion process.

-

How fluid are your processes? When a team is small, the financial close tends to be fluid and flexible. As the company grows, the systems and processes become more complex. Teams start to make the system work around their operations rather than working your operations around the system's capabilities. If you implement early, you can build your financial close around what the system does well.

-

How comfortable is your board with a significant deficiency in internal controls? One downside of QuickBooks is the lack of system controls. Your external auditors will note this deficiency and bring this to the attention of your board and audit committee. While this issue is expected as the company transitions from private to public, your board might not like the sound of a significant deficiency. Depending on the mindset of your board, you may want to consider this in your decision. Regardless, you will need a transition plan to upgrade your accounting systems after going public.

The decision to implement NetSuite is a decision that should be thoughtful and thorough to ensure success. The team should weigh the NetSuite implementation timing against the pressures of an IPO. I recommend making this transition before your planned IPO instead of after.

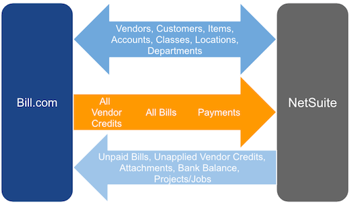

Contact OptimalData to migrate your financial data from QuickBooks to NetSuite. We have the tools and experience to ensure all your data is accurate and will free you and your team up to focus on running your business and preparing for an IPO.

OptimalData consulting provides data conversion services for organizations implementing NetSuite. Check out our NetSuite data migration solutions to see the available options pricing.