Implementation, Segments, GL Accounts

July 25, 2023

3 min Read

Eight considerations when importing the chart of accounts in NetSuite

OptimalData Consulting provides data conversion services for organizations implementing NetSuite. Learn about our data migration service or our implementation resource page for articles on the implementation process.

Introduction

Importing the chart of accounts (COA) is one of the first steps in a NetSuite implementation. Creating a chart of account structure is subjective. It should be based on the industry and the needs of various stakeholders. A proper segment structure will help optimize NetSuite's accounting and reporting functionality.

This list includes tips and tricks from assisting 60+ clients with their NetSuite implementation.

Let's get started.

Eight Considerations When Importing the Chart of Accounts in NetSuite

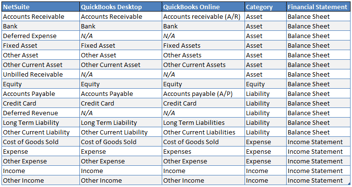

1. Review the Account Type of credit card, other AR and AP accounts, and prepaid expenses

Users cannot change the Account Type once the account has been created. Review the Account Type before creating the account and loading historical activity to prevent the need to reclassify any historical data. Certain account types have additional functionality. For example, the "Deferred Expense" account type will allow you to create amortization schedules.

2. Limit Accounts Payable (AP) and Accounts Receivable (AR) accounts to a 3rd party, an allowance for bad debt AR account (AR only), and an intercompany account

QuickBooks and NetSuite will include all AP and AR accounts in the standard subledger reports. Clients often get frustrated when running a subledger that does not tie to a single account. Unfortunately, adding an account filter on the subledger reports can be inconsistent if clients use journal entries to post subledger activity. Non-operating accounts, such as other receivables, are best classified as an 'Other Current Asset' account type.

3. Avoid building your financial statements in the account structure

I recommend grouping accounts based on shared functions, not the financial statement groupings. Most likely, users will need to customize the financial statement line items in NetSuite. Adding multiple parent-child relationships in the GL account structure is messy.

4. Utilize the Summary account feature before loading historical transactions

This step will prevent users from accidentally mapping historical activity to a summary account. If this happens, NetSuite will throw an error, forcing you to remap this activity to an active child account. An experienced data migration expert will know to check this before loading any data. OptimalData's proprietary data migration tool completes this check for you.

5. Use the Analytics workbook to access all fields associated with Accounts

The Eliminate Intercompany Transactions and Currency fields are unavailable in an 'Account' saved search. If you need an Excel report with this information, use the Analytics workbook instead.

6. Don't restrict the account currency

Bank and Credit Card account types require a currency. By not adding a currency, users give themselves more flexibility to use the accounts in the future. Unfortunately, users cannot change the currency on the account once it is set. You will need to create a new account without the Currency field populated.

7. Set all accounts to all subsidiaries unless you have a good reason

Unless otherwise needed, set the subsidiary to the parent and check the 'Include Children' box. This setting can be changed in the future if needed with a CSV upload.

8. Use the system-generated accounts whenever possible

NetSuite will generate several system-generated accounts when you activate the NetSuite instance. Users should rename and renumber these accounts instead of creating new accounts. NetSuite will default to the system-generated accounts whenever you create a new transaction. For more documentation, check out this article on Prolecto's website.

Conclusion

Are you preparing the chart of accounts as part of your NetSuite implementation? Are you concerned with how your legacy data will be imported from QuickBooks into NetSuite? Talk to us today to discover how OptimalData Consulting can efficiently and accurately migrate your detailed transactions from your legacy system into NetSuite.