NetSuite, Implementation, Data Migration

January 10, 2024

4 min Read

Seven reasons to trust OptimalData with your NetSuite data migration

Ask an ERP consultant about loading historical transactions; they will likely cringe, cry, or persuade you to think again. There is a good reason for this. Anderson Frank, a NetSuite recruitment agency, recently estimated that the #2 cause of project delays is due to data migration. Loading detailed transactional data vs. summary-level data creates significant risk if the person preparing this data isn’t careful.

Enter OptimalData Consulting.

Our process systematically validates the data migration before we start loading any data. We are not manually manipulating spreadsheets. Instead, we have built a Python-based tool based on our experience with 60+ NetSuite data migration projects. Below are seven ways our tool validates your data:

-

Validate that account type mappings are compatible - certain functions are limited to specific accounts in NetSuite. For example, users can only pay vendor bills with a Bank or Credit Card account type. We validate that account types between QuickBooks and NetSuite are compatible when migrating historical transactions. This check reduces the risk that transaction values will be incompatible when loaded into NetSuite.

-

Validate that all segment values are mapped correctly - every transaction in the legacy system includes segment values such as GL account, vendor/customer, department, and class fields. We validate that each segment value is mapped and flag any missing legacy segment values. This check reduces the risk that you will lose data in NetSuite.

-

Validate that all transaction types are mapped and importable - users cannot import certain transactions into NetSuite. For example, users can’t import deposit transactions. We ensure that transaction types, like deposits, get imported as journal entries instead. This check reduces the risk that transactions will fail upon loading into NetSuite.

Read how SmartLabs migrated detailed transactions from 15 QBO files to a single NetSuite instance

-

Validate that proposed transactions are compatible in NetSuite - certain transaction types will fail if using an incorrect account. For example, NetSuite will not allow a vendor bill to include accounts payable account types on the expense line. We validate that these scenarios do not exist in the data set. And, we proactively change the transaction type to ensure all transactions load correctly. This check reduces the risk that the transaction population will be incomplete.

-

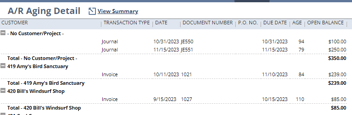

Validate vendor and customer payment applications - Vendor payments must be applied to outstanding vendor bills to be imported accurately. Customer payments often are applied against customer invoices. We validate the NetSuite CSV import files include the correct application linkage. This check reduces the risk of incorrect accounts receivable and payable sub-ledgers.

-

Validating the foreign exchange impact of transactions - Accounting software should create a realized gain/loss foreign exchange impact on non-native currency transactions. We remove the legacy system’s GL impact and leverage NetSuite to make this GL impact. This check reduces the risk that the foreign currency GL balances won’t tie after the data migration.

-

Validate that the debits and credits - All individual transactions must have a matching debit and credit balance. We validate that all transactions balance after running your data through our process. This check reduces the risk that NetSuite will reject non-balancing transactions.

Still skeptical? Don’t just take it from me. Here are some quotes from our past clients and implementation partners:

-

[OptimalData Consulting] was instrumental in helping migrate from QuickBooks to NetSuite. He made the process smooth and stress-free with a strong technical and operational expertise. His breadth of knowledge empowered us to make key systems decisions. We could not have done it without him! - Tara Maduri, Senior Accounting Manager at Foghorn Therapeutics

-

[OptimalData Consulting] has been an excellent resource for our clients looking to import historical transactions. Our partnership has resulted in smoother projects, fewer project delays, and, most importantly, happier clients. - Jon Keyes, Senior Manager at Centium Consulting

-

I can’t begin to explain the benefit we obtained from our partnership with intheBlk Consulting. A very intricate conversion was accomplished seamlessly with their ownership of the data conversion process and the ability to provide limited downtime. Our data was converted in a long weekend, and we were up-and-running by the first business day of the new week. Thanks to Paul and OptimalData Consulting for making a daunting conversion almost easy! - Robin Feeney, VP of Accounting and FP&A at SmartLabs

Ready to get started? Contact us today to schedule a call to discuss your customized data migration plan.

.png?width=352&name=NetSuite%20CSV%20Import%20Tool%20(1).png)