Financial Statement Audit, Systems, Technology

June 12, 2019

1 min Read

Financial Statement Audit, Systems, Technology

June 12, 2019

1 min Read

Over the past few months, intheBlk has been working on building a Black-Scholes calculator to assist accountants with their stock-based compensation expense. Our calculator allows users to enter the six inputs and have the Black-Scholes valuation automatically calculated. The two challenging inputs are the peer-group volatility and risk-free interest rate. Typically, users calculate these inputs in Excel by downloading historical data from Yahoo Finance and the US Treasury. intheBlk's calculator takes this burden away and automates the whole process.

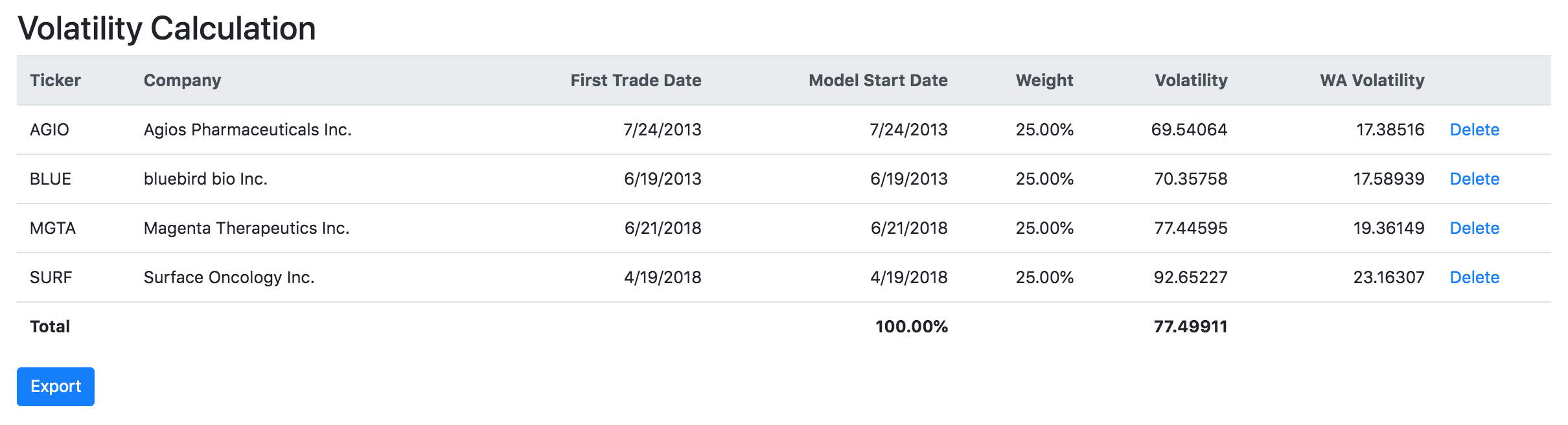

The volatility calculation allows users to add public company tickers and assign a weight to that company's volatility. Users also can restrict the start date of the stock. The use case for this is if you wanted to exclude the first year of trading in a given stock. Finally, all historical data can be exported to a CSV file.

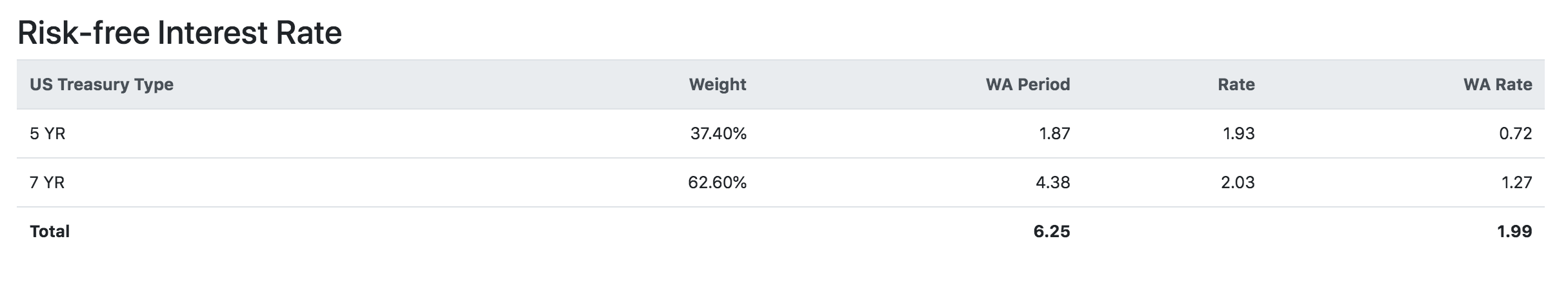

The risk-free interest rate is driven based on the as-of date and expected term for the grant. Using the US Treasury rate, the calculator finds the weighted-average rate to get the period risk-free rate.

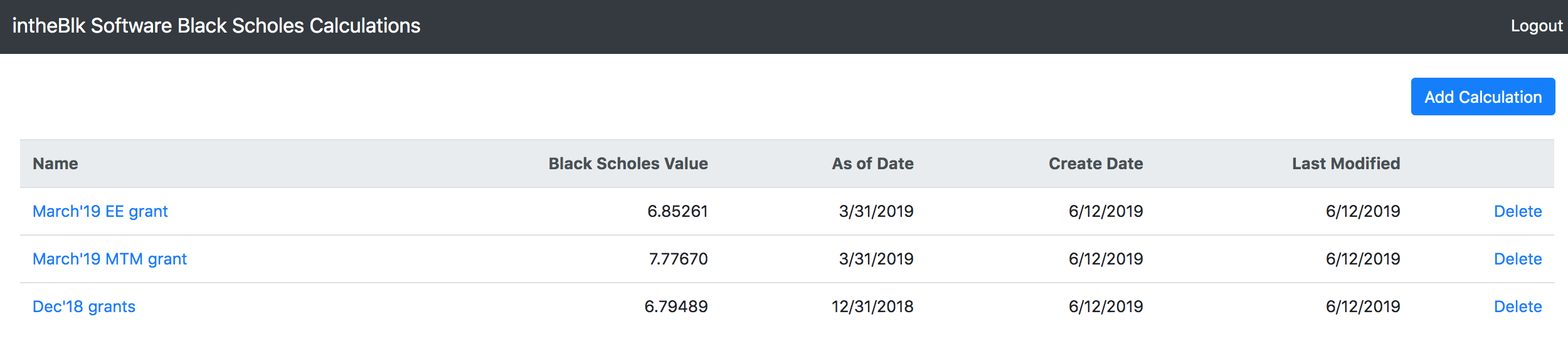

Users can easily organize and maintain all of their stock-option grants. Quickly add and review prior period grants. And because intheBlk is a stand-alone tool, you don't need to worry about losing your data when you outgrow your current equity administration tool. Many early-stage biotech companies eventually use E*Trade's EquityEdge platform, which does not have an accounting module for calculating the Black-Scholes for option grants. Our tool is built around users who use EquityEdge.

To find out if intheBlk's tool is right for you, contact us today. We are running a free trial for interested companies for their Q2'2019 close. Contact us to find out more.

NetSuite, Implementation, Data Migration

June 12, 2019

Technology, Procurement, Biotech Industry

June 12, 2019

Financial Reporting, Procurement, Implementation

June 12, 2019

NetSuite, Implementation, Data Migration

June 12, 2019

Budgeting, Biotech Industry

June 12, 2019

NetSuite, Implementation, Data Migration

June 12, 2019